To use this tool you will need your cars. Fast and easy 2021 sales tax tool for businesses and people from Fort Myers Florida United States.

Nj Car Sales Tax Everything You Need To Know

Nj Car Sales Tax Everything You Need To Know

You pay 25000 for the new car saving you 5000.

Car sales tax calculator florida. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. In addition according to the Florida Department of Revenue some Florida counties have an additional discretionary sales surtax that applies to the first 5000 of the purchase price. The state general sales tax rate of Florida is 6.

Find your state below to determine the total cost of your new car including the car tax. However if you buy from a dealer and get a manufacturers rebate Florida does not deduct the rebate amount from the purchase price. Sales Tax is set at 975.

You can use our Florida Sales Tax Calculator to look up sales tax rates in Florida by address zip code. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Free online 2021 US sales tax calculator for Fort Myers Florida.

So 10000 x0975 or 975 97500 in sales tax. Under Florida state law the Florida Department of Revenue collects 6 sales tax on 28000 which is the advertised full purchase price of 30000 minus the 500 dealer discount and 1500 trade-in allowance but not minus the 3000 manufacturers rebate. It should be noted that the local tax is only applied to the first 5000 dollars of the cost of the vehicle.

There is no city sale tax for the Florida cities. You would owe 1200 in sales tax. Calculate car sales tax example.

The base tax rate for all motor vehicles as of 2015 is 6 percent. Calculating Sales Tax Florida sales and use tax in the amount of 6 is collected on the purchase price less trade in on all vehicle transfers of ownership. Lets say the purchase price of a car is 20000.

Sale of 20000 motor vehicle to a resident of another state where the sales tax rate on motor vehicles is seven percent. 20000 purchase price x 006 sales tax percentage 1200 sales tax owed. Cost of the car is 10000.

According to The Nest to calculate the sales tax you will need to multiply the price you paid for the car by the current sales tax rate. Sales tax payments are due to the Florida Department of Revenue by the first day of the following month. The full purchase price generally is the amount you actually pay for the vehicle.

The Department of Revenue offers a Georgia sales tax calculator that allows residents to calculate their Title Ad Valorem Tax on a vehicle. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in with a maximum tax rate of 15. Floridas general state sales tax rate is 6 with the following exceptions.

4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Florida sales tax is due at the rate of six percent on the 20000 sales price of the vehicle. Hillsborough County residents currently pay a 25 discretionary sales surtax on the first 5000 of taxable value.

Regardless of whether you purchase a vehicle new or used you must pay sales tax on the full purchase price. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. For example if you are a Florida resident and are buying.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. If youre late paying the sales tax to the Florida Department of Revenue it charges a 10 percent penalty.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. To calculate Florida sales tax on a vehicle multiply the whole dollar amount by the tax rate. Florida assesses a state sales tax of 6 percent on the full purchase price of the vehicle at the time of publication.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rateExp Denver. Motor Vehicle Trailer ATV and Watercraft Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Florida cities andor municipalities dont have a city sales tax.

Discretionary sales surtax in Florida. In addition some counties charge a local discretionary sales surtax. 635 for vehicle 50k or less.

No discretionary sales surtax is due. Every 2020 combined rates mentioned above are the results of Florida state rate 6 the county rate 0 to 25. Some counties in Florida also charge a discretionary sales tax which is applied only to the first 5000 of the sale price.

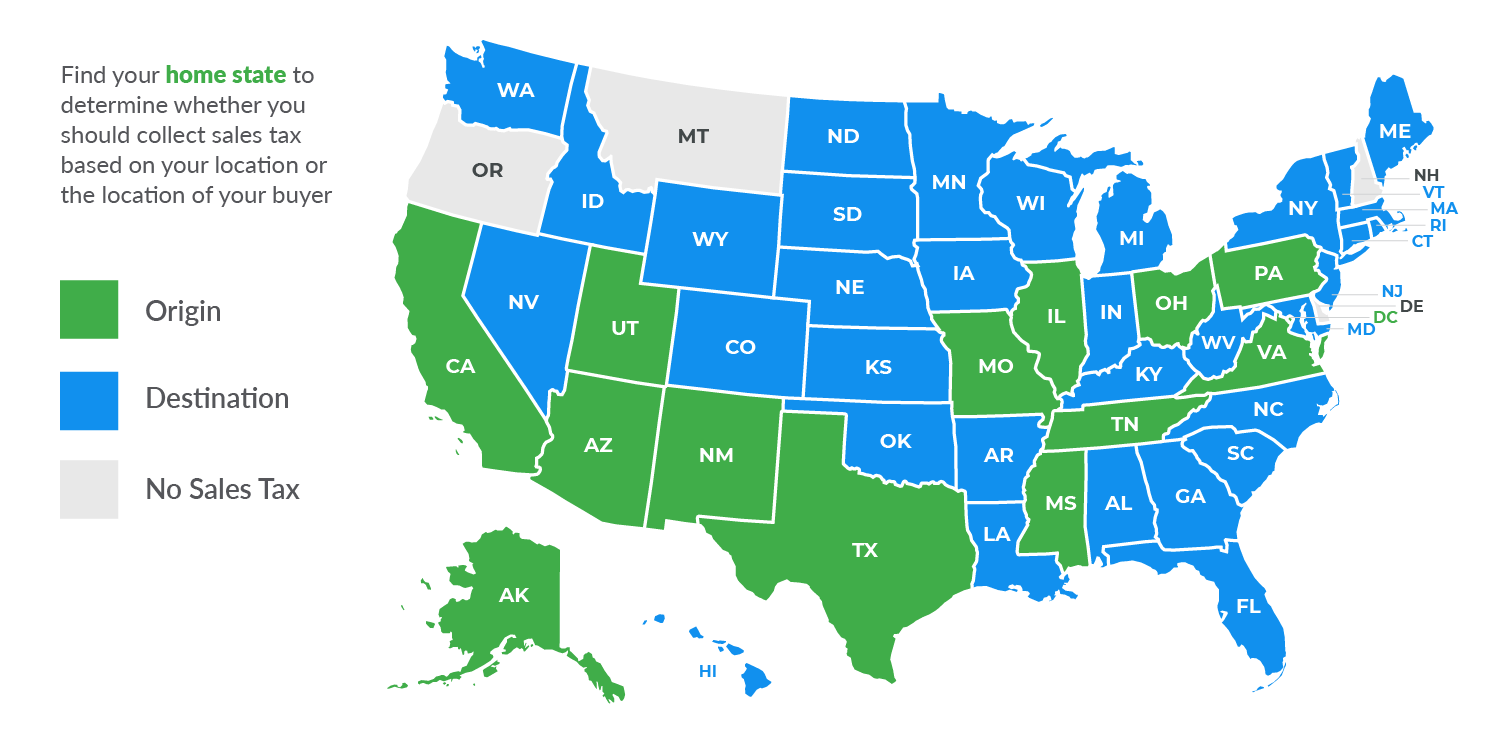

Origin Based And Destination Based Sales Tax Collection 101taxjar Blog

Origin Based And Destination Based Sales Tax Collection 101taxjar Blog

How To Calculate Sales Tax Video Lesson Transcript Study Com

How To Calculate Sales Tax Video Lesson Transcript Study Com

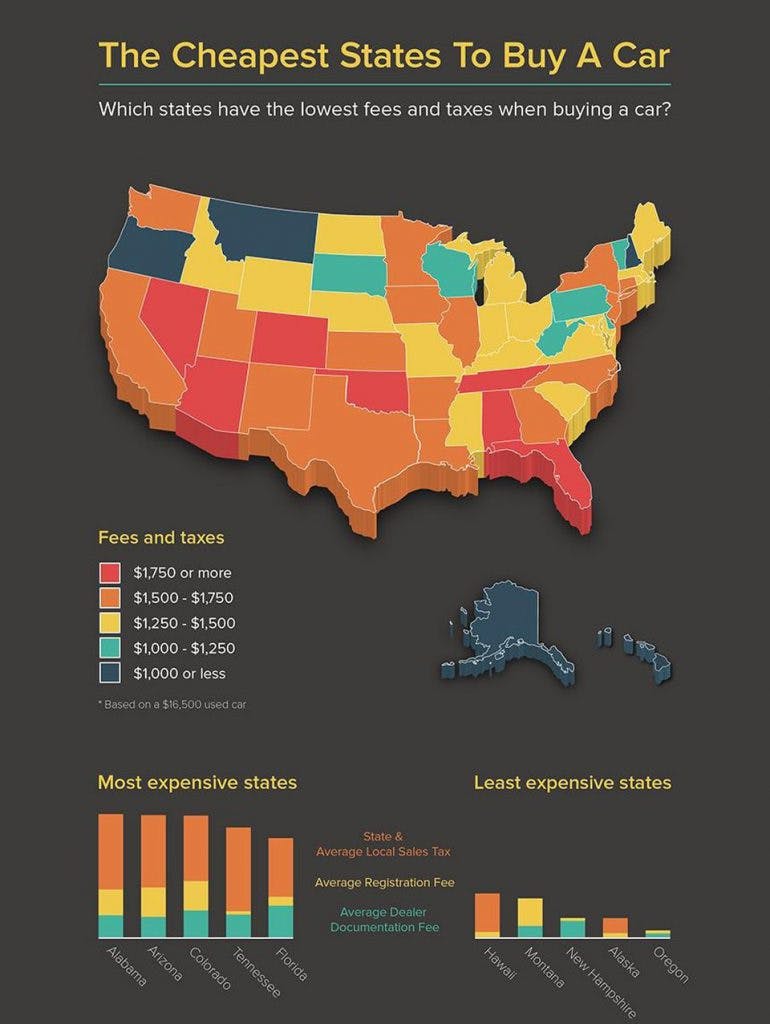

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

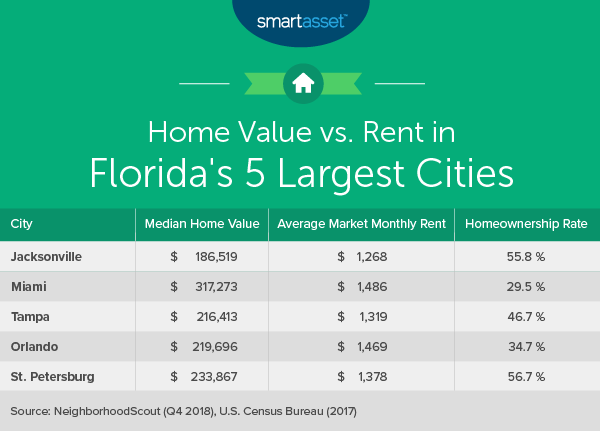

The Cost Of Living In Florida Smartasset

The Cost Of Living In Florida Smartasset

How To Calculate Florida Sales Tax 12 Steps With Pictures

How To Calculate Florida Sales Tax 12 Steps With Pictures

How To Calculate Fl Sales Tax On Rent

How To Calculate Fl Sales Tax On Rent

Florida Car Sales Tax Everything You Need To Know

Florida Car Sales Tax Everything You Need To Know

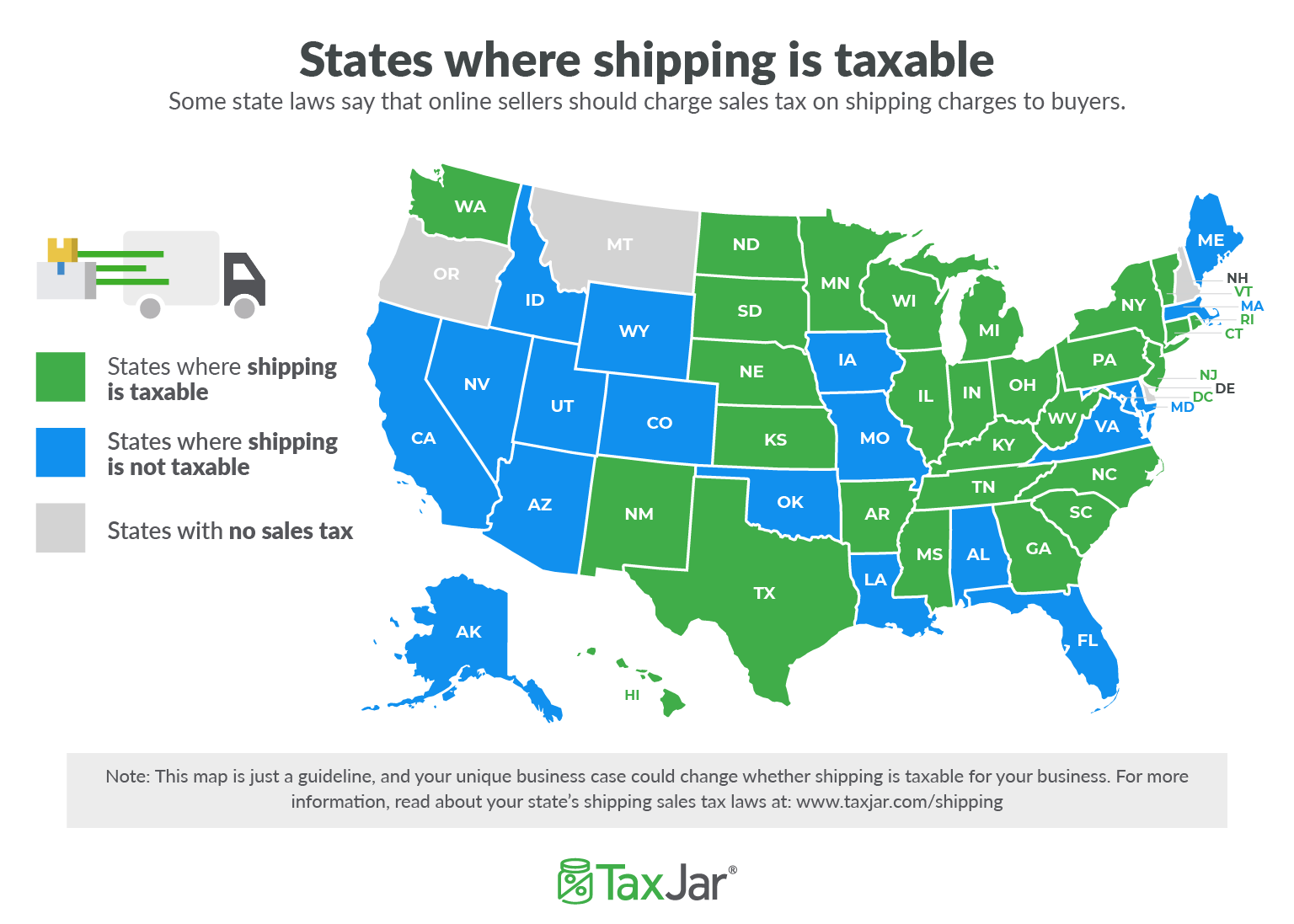

Is Shipping Taxable Taxjar Blog

Is Shipping Taxable Taxjar Blog

Sales Tax Help Tax Help Sales Tax E Commerce Business

Sales Tax Help Tax Help Sales Tax E Commerce Business

Https Www Polktaxes Com Dealers Forms Motorvehiclesalestaxratesbystate Pdf

Tag Title By Mail Orange County Tax Collector

Tag Title By Mail Orange County Tax Collector

How A State S Tax Laws Can Impact The Cost Of Your Car Lease Carlease Com

How A State S Tax Laws Can Impact The Cost Of Your Car Lease Carlease Com

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Florida Sales Tax On Cars For 2019

Florida Sales Tax On Cars For 2019

Tax Comparison Florida Verses Georgia

Tax Comparison Florida Verses Georgia

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Posting Komentar

Posting Komentar