Calculating Sales Tax Summary. To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625.

Lakeline Mall Mall Cedar Park Shopping Center

Lakeline Mall Mall Cedar Park Shopping Center

Standard Presumptive Values Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value.

Car sales tax in austin texas. CityCountyother sales tax authorities do not apply. Independent sales reps of direct sales organizations direct sales organizations are required to collect sales tax from the independent distributors. The Austin Texas general sales tax rate is 625.

SPV applies wherever you buy the vehicle in Texas or out of state. Some dealerships may charge a documentary fee of 125 dollars In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. If you purchased the car in a private sale you may be taxed on the purchase price or the standard presumptive value SPV of the car whichever is higher.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. The Texas DMV recommends going with the buyer to your local county tax office to ensure that the application for a new car title has officially been filed. If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle is titled.

Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. The title registration and local fees are also due. The best way to figure these taxes is to go to the website for taxes in TexasYou can enter the city and county you live in and then will be given the rate of taxation for that location.

Accurate sales tax rates are determined by exact locations. For additional tips on protecting yourself and securing a safe and profitable sale our Guide to Selling Your Car offers answers from the first step to the last. The SPV is calculated based on similar sales in the region.

The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local countys tax. The sales tax for cars in Texas is 625 of the final sales price. According to the Texas Department of Motor Vehicles car owners must pay a motor vehicle tax of 625 percent.

Depending on the zipcode the sales tax rate of Austin may vary from 63 to 825 Every 2021 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the Austin tax rate 0 to 2 and in some case special rate 0 to 2. Research compare and save listings or contact sellers directly from 10449 vehicles in Austin. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

OR acquire taxable goods or taxable services from out-of-state suppliers that do not hold a Texas Sales and Use Tax Permit use tax Who does not need a sales tax permit. Minimum combined sales tax rate value. Texas has a 625 statewide sales tax rate but also has 827 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1372 on top of the state tax.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. Find your state below to determine the total cost of your new car including the.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. 625 percent of sales price minus any trade-in allowance. For example if you purchased a car with a sales price of 16000 the tax on the vehicle is 16000 multiplied by 625 percent or 1000.

Texas car tax is going to vary because of city county and state taxesEach city has their own rates of taxation as do the counties as well. Sales tax on a car purchase in Texas is 625 regardless of where you buy it.

Texas Used Car Sales Tax And Fees

Texas Used Car Sales Tax And Fees

Texas Thrift Store Austn Thrifting Thrift Store Austin Bucket List

Texas Thrift Store Austn Thrifting Thrift Store Austin Bucket List

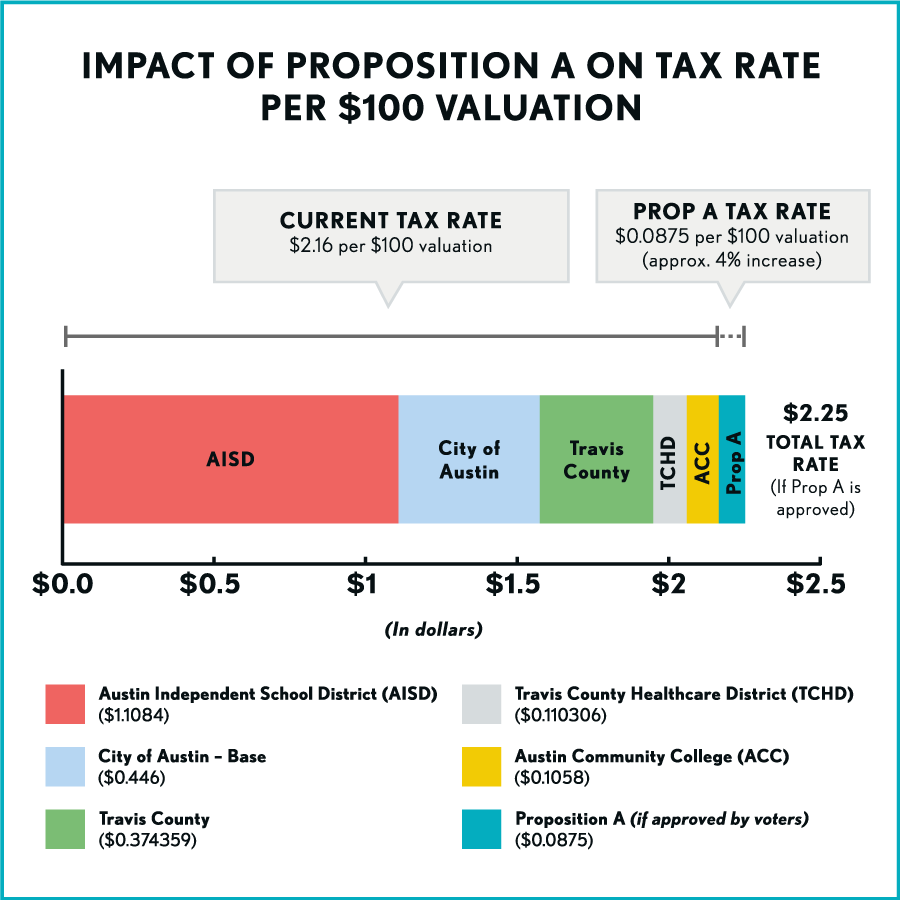

2020 Mobility Elections Proposition A Austintexas Gov

2020 Mobility Elections Proposition A Austintexas Gov

Best Western Our Favorite Modern Homes In Texas By Aaron Britt From Modern House House Exterior Houses In Austin

Best Western Our Favorite Modern Homes In Texas By Aaron Britt From Modern House House Exterior Houses In Austin

Car Donations Utah Car Donate Local Hospitals

Car Donations Utah Car Donate Local Hospitals

Texas Car Sales Tax Everything You Need To Know

Texas Car Sales Tax Everything You Need To Know

1960 S Foothills Motors Of Fontana Inc Chrysler Dodge Dealership Fontana California Dodge Dealership Mopar Dealership

1960 S Foothills Motors Of Fontana Inc Chrysler Dodge Dealership Fontana California Dodge Dealership Mopar Dealership

Rent A Moturis Rv For Your Winter Holiday And Take Advantage Of An Amazing All Inclusive Package At Low Low Rates Package Rv Rental Rv All Inclusive Packages

Rent A Moturis Rv For Your Winter Holiday And Take Advantage Of An Amazing All Inclusive Package At Low Low Rates Package Rv Rental Rv All Inclusive Packages

Ebay Mg Midget 1275cc 1973 Rwa Tax Exempt In Damask Red Classiccars Cars Ukdeals Rssdata Net

Ebay Mg Midget 1275cc 1973 Rwa Tax Exempt In Damask Red Classiccars Cars Ukdeals Rssdata Net

Us Marshal Auctions Gaston Sheehan Auctioneers Travis County Austin City

Us Marshal Auctions Gaston Sheehan Auctioneers Travis County Austin City

Travel Back In Time On Burnet Road Burnet Austin Texas My Love

Travel Back In Time On Burnet Road Burnet Austin Texas My Love

Http Www Americanbantam Com Images Me And Mike Jpg Austin Cars Classic Chevrolet Tiny Cars

Http Www Americanbantam Com Images Me And Mike Jpg Austin Cars Classic Chevrolet Tiny Cars

Cars For Sale In Maryland No Sales Tax But There Is Tax Certification Luxury Running White Cars In Maryland Free Download Photo Of Running

Cars For Sale In Maryland No Sales Tax But There Is Tax Certification Luxury Running White Cars In Maryland Free Download Photo Of Running

Car Donation Update Car Donate Car Donate

Car Donation Update Car Donate Car Donate

Lexus Dealer Targets Tesla Owners With Cheeky Ad You Ve Had Your Fun Says Austin Dealership Lexus Dealer Lexus Tesla Owner

Lexus Dealer Targets Tesla Owners With Cheeky Ad You Ve Had Your Fun Says Austin Dealership Lexus Dealer Lexus Tesla Owner

Long Term Short Term Capital Gains Tax Rate For 2013 2019 Http Capitalgainstaxrate Bravesites Com Entries General Long Sales Tax Capital Gains Tax Chart

Long Term Short Term Capital Gains Tax Rate For 2013 2019 Http Capitalgainstaxrate Bravesites Com Entries General Long Sales Tax Capital Gains Tax Chart

Austin Tx Neighborhood Descriptions Austin Neighborhoods The Neighbourhood Loft Style

Austin Tx Neighborhood Descriptions Austin Neighborhoods The Neighbourhood Loft Style

Posting Komentar

Posting Komentar